MAKE IT SIMPLE

One Team. One Goal. One Solution

-

Cloud Solutions

Simplify your business, gaining maximum agility and efficiently with the ability for future scalability all with zero cost of capital.

-

Managed Services

Leave your IT problems to us. Establishing a seamless integration into your business environment, assisting in day-to-day solutions while you focus on ensuring your business runs smoothly.

-

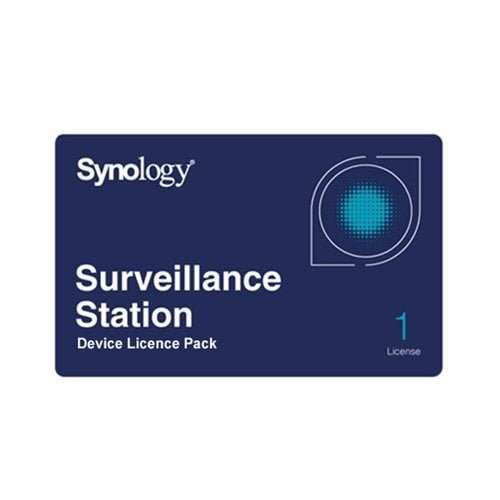

Network Security

Safeguard your business.

Keep all critical documents safe so you do not have to worry should in times of unexpected circumstances. -

Enterprise System Appliances

Maximize productivity.

Affordable and customized solutions that maximizes business productivity, increasing overall efficiency and profitability.

High-Performance Servers, Right On Site

Our on-premise server solutions give you the speed and stability you need—right in your own space. Run important apps, store big data, and stay in control of everything without relying on the cloud.

HPE Server

-

HPE ProLiant DL380 Gen11 Server (P82652-375)

Regular price $6,172.05 SGDRegular priceUnit price / per -

HPE ProLiant DL360 Gen11 Server (P81572-375)

Regular price $5,892.60 SGDRegular priceUnit price / per -

HPE ProLiant DL20 Gen11 Server (P81568-375)

Regular price $2,525.55 SGDRegular priceUnit price / per -

HPE ProLiant MicroServer Gen11 Server (P79744-375)

Regular price $2,488.60 SGDRegular priceUnit price / per -

HPE ProLiant ML30 Gen11 Server (P82650-375)

Regular price $2,213.75 SGDRegular priceUnit price / per -

HPE ProLiant ML350 Gen11 Server (P79762-375)

Regular price $6,132.95 SGDRegular priceUnit price / per

Lenovo Server

-

Lenovo ThinkSystem SR650 V3 12C - 2U Server (7D76CTO1WW-CTO2)

Regular price $6,658.50 SGDRegular priceUnit price / per -

Lenovo ThinkSystem SR650 V3 8C - 2U Server (7D76CTO1WW-CTO1)

Regular price $6,543.50 SGDRegular priceUnit price / per -

Lenovo ThinkSystem SR630 V3 12C - 1U Server (7D73CTO1WW-CTO2)

Regular price $6,486.00 SGDRegular priceUnit price / per -

Lenovo ThinkSystem SR630 V3 8C - 1U Server (7D73CTO1WW-CTO1)

Regular price $6,359.50 SGDRegular priceUnit price / per

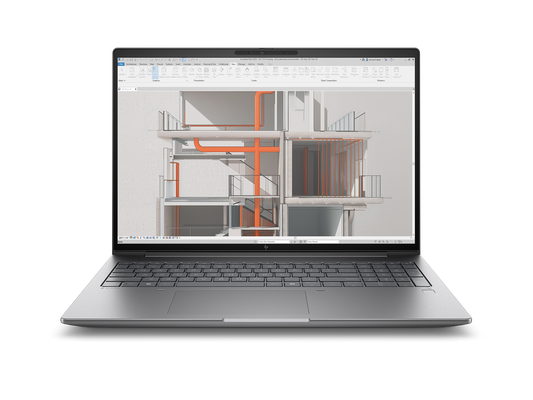

HP Laptops & Desktops

-

HP ZBook X G1i 16" Workstation Wolf Pro Security Edition U7-255H/32GB/1TB (C9EY2PT)

Regular price $2,359.00 SGDRegular priceUnit price / per -

HP ZBook 8 G1i 14" Workstation U7-255H/32GB/1TB (Touch Screen) (C1KR6PT)

Regular price $1,870.00 SGDRegular priceUnit price / per -

HP ZBook 8 G1i 14" Workstation U5-235U/16GB/1TB (C1KR8PT)

Regular price $1,544.00 SGDRegular priceUnit price / per -

HP ZBook 8 G1ah 14" Workstation Ryzen 5 Pro 230/16GB/1TB (Touch Screen) (C1KR5PT)

Regular price $1,446.00 SGDRegular priceUnit price / per -

HP ZBook Ultra 14" G1a Workstation Ryzen Ai Max 385/32GB/1TB (Touch Screen) (C1KR3PT)

Regular price $2,536.00 SGDRegular priceUnit price / per

HP Accessories

-

HP Poly Voyager Legend 50 (AV4P1AA)

Regular price $130.00 SGDRegular priceUnit price / per$158.95 SGDSale price $130.00 SGDSale -

HP Poly Voyager Legend 30 (AV4P5AA)

Regular price $111.97 SGDRegular priceUnit price / per$132.95 SGDSale price $111.97 SGDSale -

HP 925 Ergonomic Wireless Programmable Mouse

Regular price $146.78 SGDRegular priceUnit price / per -

HP 685 Comfort Dual-Mode Keyboard and Mouse Combo (Programmable Keys & Buttons)

Regular price $127.52 SGDRegular priceUnit price / per -

HP 725 Multi-Device Rechargeable Wireless Keyboard and Mouse Combo

Regular price $127.51 SGDRegular priceUnit price / per

Explore More

-

Lenovo Server

Explore our collection of Lenovo server and storage systems, designed to deliver performance,...